JEO 3 - Japan's Space Strategy Fund

A monthly news roundup and a deep-dive on Japan's Space Strategy Fund.

Welcome to Japan Earth Observer (JEO), a free monthly newsletter with a news roundup and one in-depth article about the space, Earth observation and geospatial industries in Japan. In addition to a news roundup, in this edition I’m also going to write a bit about the Space Strategy Fund, the Japanese government’s latest industrial policy aimed at catalyzing a globally competitive space sector.

News & Announcements

💱 Contracts and Funding

- Following up on the JAXA contract announcement in November [JEO], ArkEdge Space closed a Series B funding round [SpaceNews] for JPY 8 billion (~US$ 52.5 million) led by Incubate Fund KK. This brings ArkEdge’s total funding to JPY 10.7 billion. The JAXA contract is to develop technologies for a lunar navigation satellite system, but navigation systems is only part of its offerings. ArkEdge’s core work is designing and building standardized satellite bus systems for 6U satellites (about 50 kg) that can be used for a range of Earth observation, maritime, IoT, and communications missions. The company has grown quickly to 120 employees and an order book of JPY 32 billion including significant orders for satellite constellations for the Taiwan and Rwanda space agencies [Nikkei Asia]. ArkEdge can manufacture a few dozen satellites per year today, and aims to expand that capacity to 100 satellites per year by 2026.

- A bunch of Astroscale news this month:

- The UK subsidiary of Astroscale has secured a 590,000 Euro (USD 614,000) contract from the ESA [TSE notice][English translation] to develop the Capture Bay for Active Debris Removal (CAT) for In-Orbit Demonstration (IOD). The mission is aimed at maturing and adapting its ELSA-m rendezvous proximity operations (RPO) technology for the CAT in-orbit demonstration. Astroscale UK will be the mission and platform prime contractor for Phase A [Astroscale]. The ESA is keen to develop a capacity to service its Copernicus Earth observation satellites on-orbit as well as make progress toward its 2030 Zero Debris initiative. This is a feather in Astroscale’s cap and will help extend its lead in both debris removal and on-orbit servicing.

- Astroscale’s UK subsidiary also successfully completed its Mid-Term Review of Phase 2 for the UK Space Agency’s Active Debris Removal (ADR) mission [SpaceNews]. Astroscale is competing with Swiss firm, ClearSpace, to be selected for Phase 3 and the actual manufacturing, testing and launch of a deorbit mission that will remove two satellites using a robotic arm. Phase 2 is expected to be completed by the end of March. Astroscale already has a contract with the UKSA and ESA to deorbit a defunct OneWeb satellite in the next year using a magnetic capture mechanism on the ELSA-m vehicle.

- Astroscale UK inked a contract with BAE Systems to design, build, and test a modular satellite capable of being serviced in-orbit.

- Astroscale Japan was awarded a JPY 7.27 billion (~USD 48.5 million) contract with the Japan Ministry of Defense (JMoD) to develop and test a compact, highly maneuverable satellite that can operate in geostationary orbit in a space domain awareness (SDA) role as well as serve as an optical data relay. The initial three-year contract (through JFY 2027), if successful, will be followed by a separate contract to support launch and operations phases. Astroscale has previously focused on the civilian government and commercial sectors and this is its first defense and intelligence contract. Geostationary SDA satellites are usually large and immobile, but China has demonstrated reconnaissance satellites that are mobile and agile, and the U.S., Japan, and allies are racing to catch up. Astroscale recent demonstrations of rendezvous and proximity operations (RPO) capabilities give it a head-start.

- Astroscale France has convinced Pierre Omaly to depart Centre National d'Etudes Spatiales (CNES) and join them as as a Senior Technical Expert. AT CNES Omaly led development of technologies for on-orbit rendezvous and proximity operations (RPO) and satellite detumbling techniques, work that is closely aligned with Astroscale’s ambitions.

- Astroscale has all of these subsidiaries in each country in order to comply with regional contracting and export control regulations, and it raises questions about the degree to which it can leverage economies of scale across the various organizations. The question came up a couple of times in the most recent earnings call Q&A, and Astroscale acknowledged that, for example, in Europe, they are required to use a local supply chain so they have to build the satellite bus for European projects using local components while the Japanese contracts use a different set of components. It seems like they are trying to share as much as regulations will allow across the various units, but it does indeed introduce some inefficiencies.

- Eutelsat signed a contract for a bunch of H3 rocket launches from Mitsubishi Heavy Industries (MHI) in Sept 2024 for launch in 2027, but Eutelsat’s recent bank and ratings agency downgrades plus board departures could put the company (and this order) in jeopardy. SpaceX Starlink, Amazon Kuiper, and Telesat are all ahead or directly competing with Eutelsat’s OneWeb on providing LEO broadband, and, given its already high debt, it’s not clear that Eutelsat will have the funds to get its second generation constellation into orbit at sufficient scale and speed to compete. That said, it’s possible that if SpaceX Starlink support is withdrawn from Ukraine, Eutelsat’s broadband could fill a particularly acute need. I think the withdrawal of support for Ukraine by the Trump administration has convinced European leaders that they need to have a sovereign LEO broadband capability under their own control.

- LSAS Tec will build a space debris monitoring facility in Yamanashi Prefecture [SatNews]. The resort town of Kiyosato is a few hours drive west of Tokyo and boasts a 1,200m elevation, a lot of clear days, and an empty primary school. LSAS Tec, a geospatial systems integrator will renovate the former school and add a monitoring telescope to the grounds to support debris tracking.

- ElevationSpace booked a launch of its 200kg AOBA payload on an Isar Aerospace Spectrum rocket in the second half of 2026. The initial launches of the German Spectrum rocket will occur from the Andøya Spaceport in northern Norway.

- Q-shu Pioneers of Space (iQPS) has signed a second launch contract with RocketLab [SatNews], bringing the total to eight dedicated launches under contract. Currently six are expected to launch in 2025 and two more in 2026. RocketLab is also launching ten satellites for iQPS’s rival SAR constellation, Synspective.

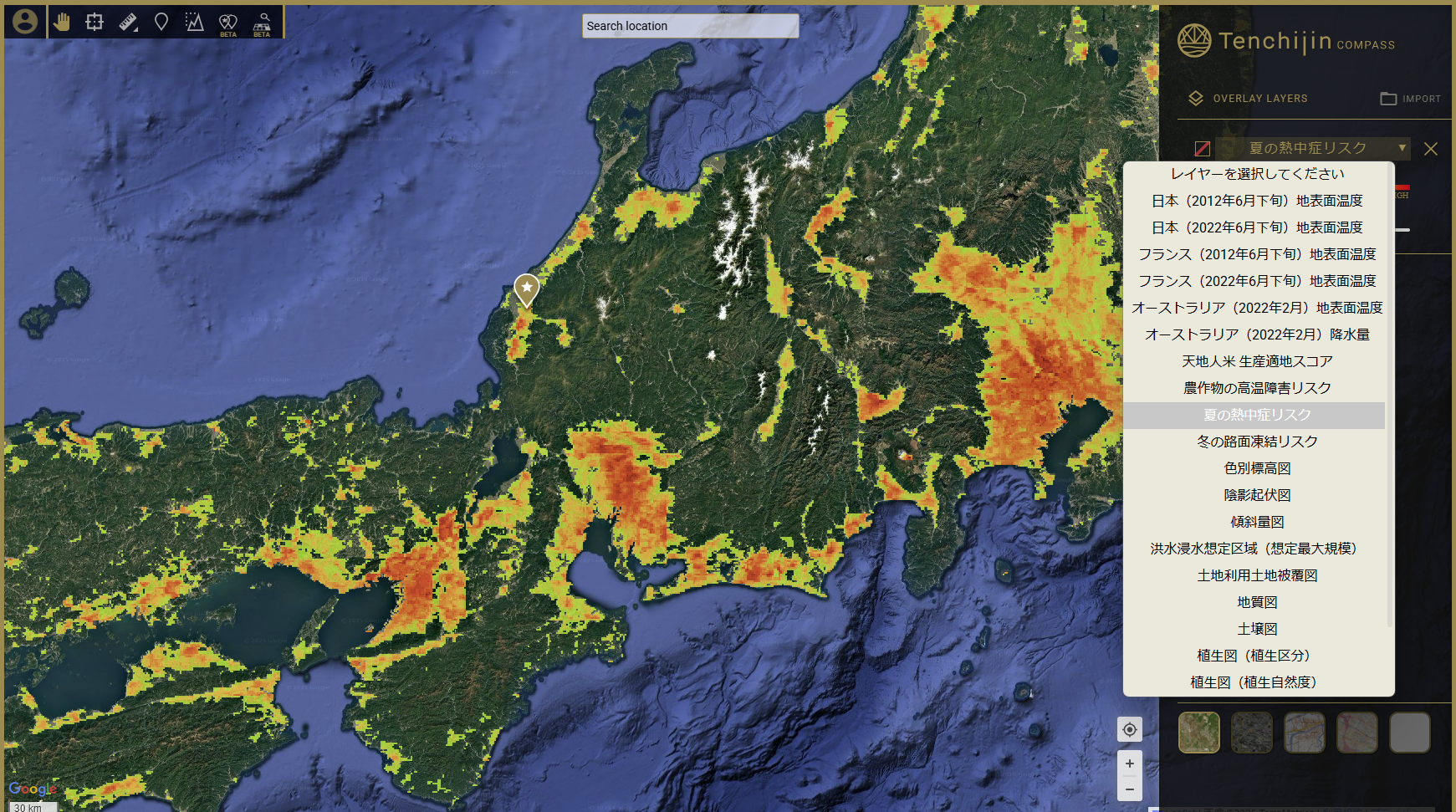

- Tenchijin has been selected by JAXA as a data service provider for the ALOS-4 [SatNews] phased array L-band synthetic aperture radar (PALSAR-3) sensor, launched in July 2024. If you read last month’s newsletter, this might sound like deja vu. In January, there was a similar announcement about a team led by PASCO (with RESTEC and Tellus) receiving a similar contract. PASCO has been a long-time distributor of ALOS data and currently supports online tasking requests for the ALOS-2 satellite as well as data search, distribution and download services for ALOS, ALOS-2, and Terra ASTER through its PLATFORM tool. JAXA seems to be hedging its bets by awarding a second contract to Tenchijin, which already operates a COMPASS tool that displays analytical results such as agricultural productivity, surface temperature, heat stroke risk, and land use/land cover maps. Tenchijin’s three-year contract will run through March 2028 (JFY2027) will enable them to build a new online distribution tool as well as provide training and workshops on how to use the data. I’ll be curious to see how Tenchijin’s distribution approach will differ from that of PASCO.

Tenchijin COMPASS application displaying mid-summer heat stroke risk. Credit: Tenchijin

🛰️ Technology and Infrastructure

- The Geospatial Information Division Lab (地理空間情報課ラボ), a unit at the Ministry of Land, Infrastructure, Transport, and Tourism (MLIT) is soliciting public feedback on the Real Estate Information Library (不動産情報ライブラリ), a real estate data application that was launched in April 2024. The application had 15 million page views in its first 10 months and they want input on how to improve it. Any user can submit a one page proposal on how to improve the application and selected proposals will have a 30 minute interview. I think this kind of user research is becoming more common in government agencies, but flinging open the doors to the entire public user base is an extraordinary step for a country of ~125 million and 65 million real estate parcels. This initiative follows a survey for input on which geospatial data formats to use for future data distribution in February (my vote was for Geoparquet and PMTiles). Kudos to the MLIT GIS Lab for the proactive and courageous user research..

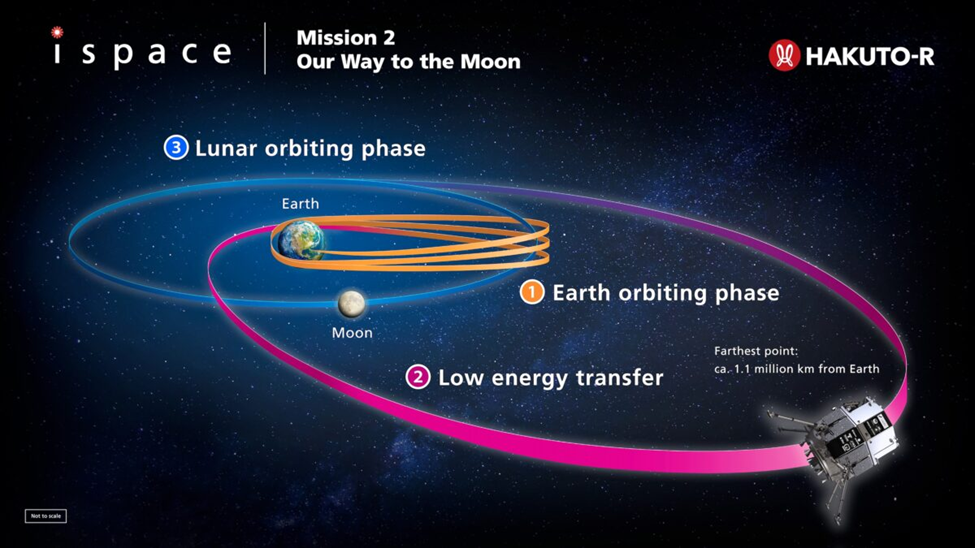

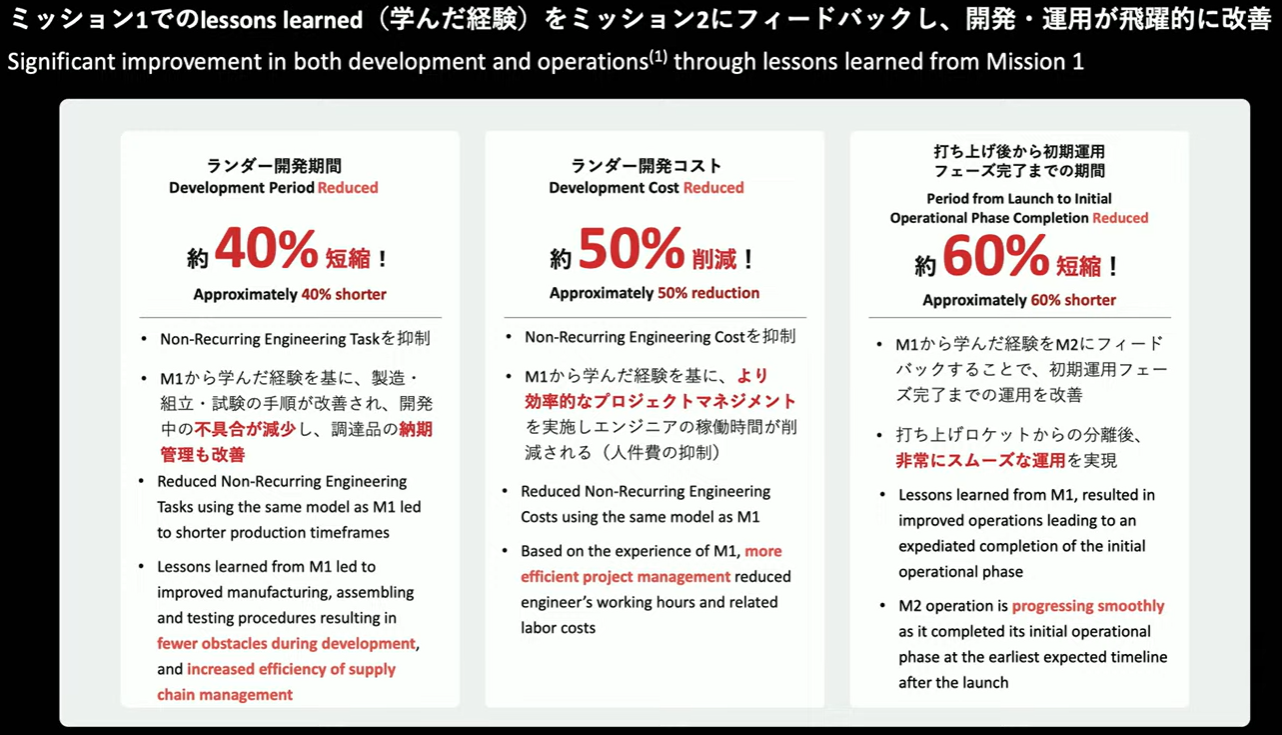

- The ispace Hakuto-R Resilience lander has raised its orbit and is now on a low energy transfer orbit to the Moon [Space.com], where it is expected to attempt a landing at Mare Frigoris in early June. It did a successful lunar flyby on Feb 15. This was Milestone 5 of the mission, and the next steps will be testing of control maneuvers and deep space survivability before lunar orbital insertion. At a mid-flight press briefing [YouTube] [Japanese version] on March 3, ispace announced that they currently project the lunar landing to occur at 4:24am JST on June 6. The ispace press briefing also highlighted how ispace has incorporated lessons from Mission 1 into its development process. These lessons learned have resulted in a 40% reduction in development time, a 50% reduction in cost, and a 60% reduction in the time from launch to operational status.

Ispace Hakuto-R M2 lander lunar transfer orbit. Credit: ispace

Mission 2 performance improvements. Credit: ispace

- Marble Visions is kicking off development of a high resolution, high frequency 3D imaging satellite constellation [NTT Data] to support development of digital twins. By collecting 3D data at 40 cm resolution and on a higher revisit cadence, they aim to update global 3D maps annually and every three to six months for major urban areas. So-called “digital twins” are high fidelity digital models of the physical environment. At the scale of a single structure, like a building or bridge, they can help with planning construction, upgrades, and maintenance, while at the scale of a neighborhood or city, a digital twin can be used for urban planning, emergency management, and public safety. NTT Data has form in this domain as it has been providing a global 5m 3D data product called AW3D using a mix of Maxar Worldview and DAICHI ALOS satellite data in collaboration with RESTEC. Marble Visions is a joint venture led by NTT Data (60%) as part of its Constellation 89 initiative and also includes PASCO (30%) and Canon Electronics (10%). Marble Vision was an early recipient of funding from the JAXA Space Strategy Fund (see below) in 2024 and they received final grant approval earlier this year. NITT’s initial capital investment was JPY 5 billion with phased funding through 2026 and an initial satellite launch planned for 2027.

- Space Compass and NTT DOCOMO have successfully tested 4G LTE communications between a smart phone and a high altitude, long-duration airplane [Space Compass] (in the argot, a high altitude platform station or HAPS). The test occurred over Kenya from the stratospheric height of 20km using an Airbus Zephyr aircraft. Space Compass, which is a joint venture of NTT DOCOMO and SkyPerfect JSAT, is aiming to launch a commercial wide-area HAPS service in 2026 and has a longer-term objective of developing an integrated HAPS and space-based communications system.

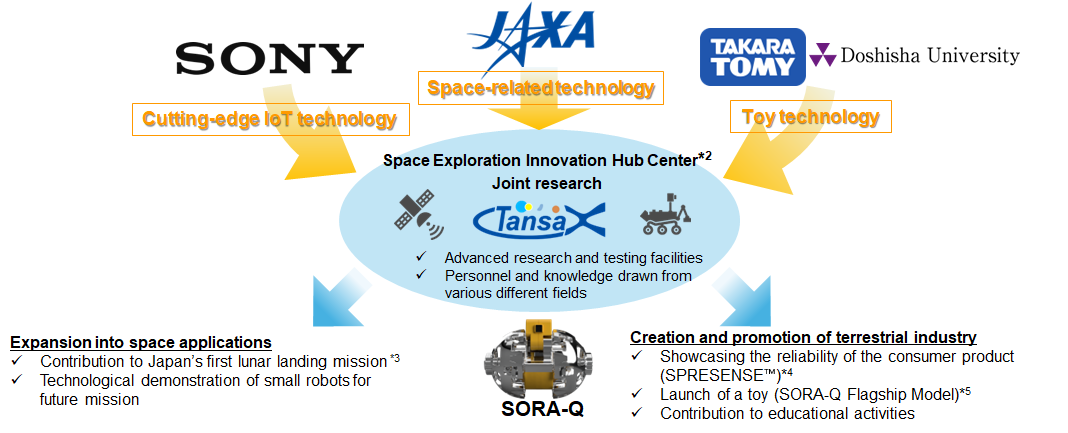

- JAXA, Sony, TOMY, and Doshisha University won the Prime Minister’s Award at the 7th Japan Open Innovation Prize for a tiny transformable lunar rover called LEV-2 and nicknamed SORA-Q. The tiny robot has a 78 mm diameter and weighs only 228 grams. It integrates toy technology from TOMY, IoT and image sensors from Sony, robotics from Doshisha University and space tech from JAXA.

Collaborators on the SORA-Q project. Credit: JAXA

🔭 Science

- The XRISM observatory’s X-ray spectrometer has detected oscillating hot gas motion in a galaxy cluster [JAXA] for the first time, providing evidence of how galaxy clusters are shaped by collisions and mergers.

🗺️ International Collaborations

- The Luxembourg Space Agency (LSA) and ispace have started releasing a multi-episode documentary about the TENACIOUS micro-rover [YouTube] that is currently making its way to the moon aboard the Hakuto-R M2 lander. While ispace is a Japanese company, it has subsidiaries in the United States and Luxembourg, and the Luxembourg unit, ispace-EUROPE, developed the rover with funding support from LSA and ESA. Additional episodes of the documentary will be released as the M2 lander makes its way to the moon.

- Ispace is also busy. On Feb 13, ispace and King Fahd University of Petroleum and Minerals (KFUPM) inked an MOU [ispace] for collaboration lunar exploration, which could include joint research as well as ispace hauling some KFUPM payloads to the lunar surface. KFUPM is the top-ranked university in Saudi Arabia and its Interdisciplinary Research Centre (IRC) for Aviation and Space Exploration will lead and coordinate the collaboration.

📆 Asia-Pacific Conferences & Events

This newsletter is mostly focused on Japan, but I also like to highlight events across the Asia-Pacific region as well.

First, YouTube videos of the FOSS4G Japan 2024 conference sessions held at Senhu University in November 2024 are now available.

Some upcoming conferences include:

- India Space Congress - 27-27 June 2025 - New Delhi, India

- Spacetide - 7 - 10 July 2025 - Toranomon, Tokyo, Japan

- 35th International Symposium on Space Technology and Science (ISTS) & 14th Nano-Satellite Symposium (NSAT) Joint Symposium - 12 - 18 July 2025 - Asti Tokushima, Japan

Japan's Space Strategy Fund: space industrial policy at scale

Japan has leveraged industrial policy for more than a century. In the Meiji era, government policy promoted steel and defense industrial production. After World War II, the national government established financial and policy support for the iron, steel, shipbuilding, machining, electrical equipment, and chemicals industries that would be necessary to rebuild the country. Later, support was added to promote automobile manufacturing, petrochemicals and nuclear power, and then, in the 1980s, computers and semiconductors were targeted as strategic industries. In addition to supporting growth and development in some industries, Japan has managed the decline of others, including chemical fertilizers and textiles. Industrial policy can take many forms:

- Targeted grants to support early stage research

- Loans to enable expansion and achieve economies of scale

- Establishing and funding industry consortia and research institutes to overcome technological barriers

- Becoming the initial customer for a nascent industry or buying from multiple firms to encourage competition

- Administrative guidance (行政指導) to advise, encourage, and persuade corporations and individuals in a desired direction

- Subsidies, tax concessions, import permits

- Encouraging universities to support certain career paths where labor shortages are anticipated

- International diplomacy to encourage exports and purchase of goods in the global marketplace

Japan is not unique in leveraging state funds and power to promote the development and advancement of strategic industries; most countries deploy industrial policy to some extent. While it does not intervene extensively in most markets, the national administrative apparatus in Japan is not shy about using industrial policy when it perceives an opportunity to grow and support an industry it believes is strategic or in which it can be competitive.

The rapidly growing space industry satisfies both of these concerns. The ability to launch payloads and operate in space based on an independent and capable domestic industrial capacity is seen as a strategic priority for both national defense and commercial reasons. Further, Japanese industry has potential competitive advantages in some areas that could potentially become global industrial leaders.

Money Strategy

Enter the Space Strategy Fund (宇宙戦略基金), a JPY 1 trillion (~US$ 6.7 billion) investment fund that aims to advance Japan’s space industry over a 10 year period in three key priority areas - 1) space transportation (rockets, spaceports, etc.); 2) satellite technology, and 3) Earth/lunar exploration - plus a category for cross-cutting topics. The fund is an industrial policy response to several observations:

- The emergence of many new space industry actors - there are now 77 space agencies around the world today, 16 of which have domestic launch capacity

- A sense that Japan’s space capabilities have seen declining international competitiveness - the rapid pace of developments in the U.S. and China are raising competitive concerns around the world

- Maintaining an independent, sovereign space capacity will require supply chain autonomy, investment in technology innovation, and government support as both R&D funder and customer.

As I have written in previous newsletters, Japan has endured deliberate efforts by the United States to restrict its rocket launch capabilities in the 1960’s and 1970’s as well as the evisceration of its domestic satellite industry through the application of the Section 301 trade law in the 1980’s and 1990’s. Combined with the Taepo Dong incident in 1998 (and no doubt reinforced by recent U.S. actions to withdraw support for Ukraine’s effort to defend itself), Japan has a healthy desire to maintain and advance a sovereign launch and satellite production capability. Further, demographic decline and nearly static economic growth limit the size of domestic market demand and generate a sense that Japanese firms need to expand internationally in order to be competitive.

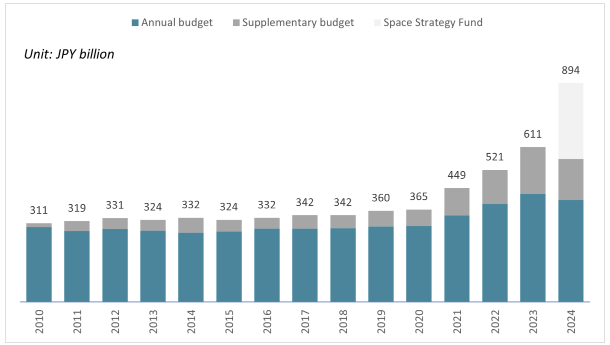

The new Fund is part of the current government space policy document, known as the “Basic Plan on Space Policy” (宇宙基本計画) approved in June 2023. That plan articulates a few high-level goals: 1) expand the commercial space industry from JPY 4 trillion in 2020 to JPY 8 trillion by the early 2030’s; 2) leverage space technology to address global issues such as energy, climate change, agriculture, forestry, water, health, etc.; and 3) cultivate knowledge of space and advance critical technologies. In the meantime, the new Fund represents a significant increase in the Japan’s civilian space budget.

Japan’s annual core budget, supplementary budget, and Space Strategy Fund 2010-2024

Credit: New Zealand Ministry of Foreign Affairs and Trade

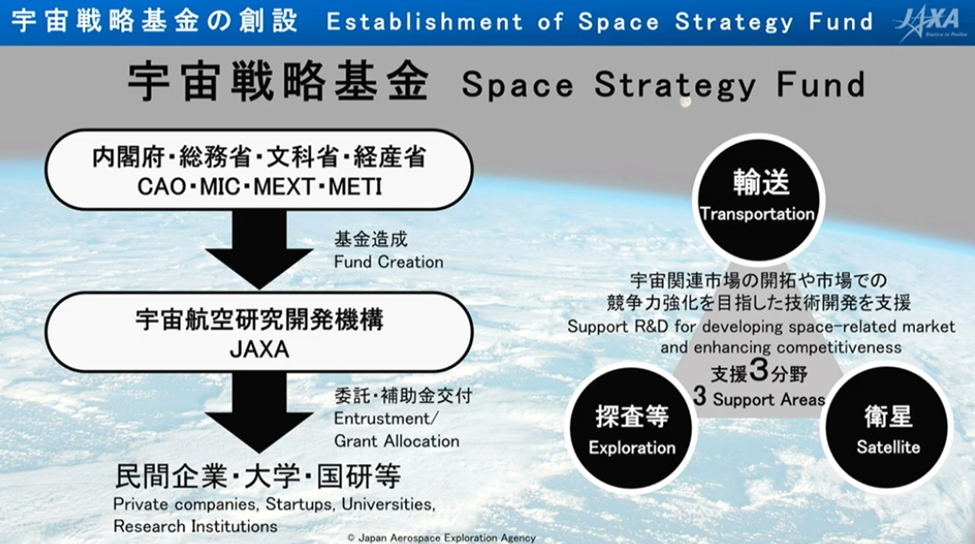

Officially launched in April 2024, the Fund provides long-term, flexible, and strategic support for private companies, universities, and national research centers. Funding for space-related priorities in Japan is split across several agencies. Overall strategy is overseen by the Cabinet Office (CAO 内閣府). Budgets related to space are allocated across four agencies: Ministry of Internal Affairs and Communications (MIC 総務省), Ministry of Education, Culture, Sports, Science and Technology (MEXT 文部科学省), the Ministry of Economy, Trade and Industry (METI 経済産業省), and the Ministry of Defense (JMoD 防衛省). The Fund does not include defense concerns per se so JMoD is not technically part of the organizational structure, but most space technologies have dual uses, and I would expect there has been some collaboration in terms of the specific themes being pursued. Otherwise, the funds flow from supplemental budgets allocated to MEXT, METI, and MIC. Using funds from these three ministries, the Japanese space agency, JAXA, is responsible for commissioning projects, organizing review committees, distributing funds, and managing the projects.

Overview of agency responsibilities and three priority areas. Credit: JAXA

Within the three priority areas - transportation, satellites, and exploration - the Cabinet Office has identified some specific quantitative results they would like to see during the 10-year life of the fund:

Space Transportation

- Increase government and commercial rocket launch cadence to 30 launches per year by the first half of the 2030s.

Satellites

- Establish at least five commercial satellite systems by 2030 at the earliest.

- Complete implementation of at least 30 major satellite data services provided by domestic commercial entities by 2030 at the earliest.

Exploration

- Enable private firms and universities to participate in at least 10 space missions to the Moon, Mars, or beyond.

- Establish 10 or more new business projects by Japanese private entities utilizing low Earth orbit (LEO) by 2030 at the earliest.

In pursuit of these objectives, JAXA and the other ministries have put together an initial list of 22 themes across the three priority areas. Starting in July 2024, solicitations were released to the private sector, committees were convened to review the proposals and contract awards have now been announced for almost all of the themes (one theme, lunar water sensors, was re-posted after no awards were made from the original solicitation).

This represents a ton of work for a single year, and a crew of people at JAXA deserve some serious kudos. While the following 22 themes represent the initial year and many of these awards will be multi-year, I would expect that JAXA will adjust the themes and issue new solicitations as necessary in subsequent years.

| Theme | Ministry Sponsor |

Solicitation Date |

Results Date |

Awards |

|---|---|---|---|---|

| 宇宙輸送 Space Transportation |

||||

| Improve weight, performance, and cost of transport vehicles |

MEXT | 7/5/2024 | 10/25/2024 1/30/2025 |

Nikon Shimizu Maruhachi Mitsubishi Heavy Industries |

| Ground infrastructure and spaceports |

MEXT | 7/19/2024 | 12/20/2024 1/17/2025 |

Nippon Yusen SPACE COTAN |

| Integrated navigation and positioning |

METI | 7/19/2024 | 11/15/2024 | Mitsubishi Precision |

| Mass production of materials for solid fuel motors |

METI | 8/23/2024 | 1/31/2025 | IHI Aerospace |

| 衛星等 Satellites |

||||

| Accelerating the construction of commercial satellite constellations |

METI | 7/5/2024 | 11/29/2024 | ArkEdge Space iQPS Synspective NEC |

| High-resolution, high-frequency optical EO satellites |

MEXT | 7/19/2024 | 11/29/2024 | Marble Visions |

| Space-borne LIDAR using high-power lasers |

MEXT | 7/19/2024 | 11/29/2024 | Kyoto University |

| Optical routers for satellite constellations |

MIC | 7/26/2024 | 11/22/2024 | NEC |

| Satellite quantum cryptography communication |

MIC | 7/26/2024 | 12/20/2024 | National Institute of Information and Communications Technology (NICT) |

| High-precision satellite formation flying |

MEXT | 8/7/2024 | 12/20/2024 | Interstellar Technologies Nagoya University Tokyo University |

| Overseas satellite data utilization system (feasibility study) |

METI | 8/23/2024 | 2/7/2025 | Umitron Ocean Eyes Ocean Solution Technology Space Tech Accelerator Solafune Pacific Consultants Japan Space Forum |

| Satellite supply chain development |

METI | 8/23/2024 | 2/28/2025 | Well Research NEC Space Technologies NU-Rei Composite Tailors Sharp Energy Solutions GS Yuasa Technology Mitsubishi Electric (2) INDUSTRIAL-X ASTEC |

| 探査等 Exploration |

||||

| Regenerative fuel cell systems |

MEXT | 7/5/2024 | 11/29/2024 | Toyota Motor |

| Lunar-Earth communications systems (feasibility study) |

MIC | 7/5/2024 | 11/15/2024 | KDDI Fukui University of Technology |

| Lunar positioning systems | MEXT | 8/7/2024 | 11/22/2024 | ArkEdge Space |

| Lunar water sensing and exploration |

MIC | 7/5/2024 | 11/29/2024 | [No awards] |

| Lunar water sensing and exploration (re-posted RFP) |

MIC | 2/14/2025 | TBD | |

| Semi-permanent lunar power supply systems |

MEXT | 8/23/2024 | 1/10/2025 | Japan Atomic Energy Agency |

| LEO experimental systems | MEXT | 7/26/2024 | 11/22/2024 | Space BD |

| LEO autonomous flight module systems |

MEXT | 7/26/2024 | 11/15/2024 | Japan LEO Corp. |

| Supply chain independence and flexibility |

MEXT | 8/7/2024 | 12/13/2024 | Japan LEO Corp. IHI Aerospace |

| Low-cost atmospheric reentry and deceleration |

MEXT | 8/7/2024 | 1/10/2025 | NeSTRA |

| 分野共通 Common Areas |

||||

| R&D Hub for Space Transformation (SX) |

MEXT | 8/23/2024 | 1/31/2025 | Nagoya University Tokyo University Ritsumeikan University National Astronomical Observatory of Japan (NAOJ) |

Other space R&D funding mechanisms

The Space Strategy Fund is new but Japan operates many other funding programs to develop new technology.

K Program: The Cabinet Office (CAO) operates a Key and Advanced Technology R&D through Cross Community Collaboration Program (K Program). The Japan Science and Technology Agency (JST) and the New Energy and Industrial Technology Development Organization (NEDO) together manage a JPY 500 billion (~ US$ 3.3 billion) fund aimed at research and development of key technologies critical for maintaining Japan’s global competitiveness. The five to ten year timeline is a good match for aerospace applications, and JAXA participates in the K Program and funds are supporting Astroscale on-orbit refueling program [Astroscale], for example.

J-SPARC: JAXA operates its own program called JAXA Space Innovation through PARtnership and Co-creation (J-SPARC), and, as the name implies, the emphasis is on partnership and co-creation. Commercial businesses are able to propose joint R&D ideas to JAXA, which, if approved, will bring human resources and funds to collaborate with business to demonstrate feasibility for a concept. A recent example is a digital twin concept being co-developed by JAXA and Space Data [JAXA] using the environmental sensors on the KIBO research module on the ISS. J-SPARC has supported about 50 projects to date, including: Astroscale, Synspective, Space One, Sony, and Kawasaki Heavy Industries.

![][image8]

J-SPARC co-creation process Credit: JAXA

JAXA-SMASH: The JAXA-Small Satellite Rush Program (JAXA-SMASH) was launched in 2022 and is aimed at accelerating the entry and commercialization of small- and medium-sized businesses developing rockets for small satellite (<50kg) missions. Recipients have so far included BD Space, Space ONE, Interstellar, and Mitsui Bussan Aerospace.

Frontier Innovations Fund was established in 2024 as an independent commercial venture capital fund. JAXA is the “anchor” limited partner (LP) with additional LPs from financial institutions and institutional investors. Frontier Innovations operates the fund as a General Partner with a focus on seed and early-stage investments.

SBIR: Small Business Innovation Research (SBIR) is an innovation funding program originally developed in the United States and has since been extended to most federal research agencies in the U.S. as well as inspiring similar programs around the world. Japan established its own SBIR program in 1999 to support innovative technology development in small businesses. It differs significantly from the U.S. SBIR program that inspired it. Rather than independent SBIR programs operated by each agency, Japan’s SBIR is an inter-ministerial program operated by the Cabinet Office and administered by the New Energy and Industrial Technology Development Organization (NEDO). Historically, only a small number of awards followed the two-phase structure (prototype and feasibility phase followed by a commercialization phase) and proportionally many awards went to relatively established firms as well as individuals, rather than the small startup companies targeted in the U.S. Further, there is no emphasis on technology transfer from universities to commercial firms, and, at least historically, the SBIR program has not provided additional commercialization support services or incentivized additional investment from venture capital funds. Following evaluations that it had been ineffective in terms of growing both sales and employment [Inoue and Yamaguchi, 2017], Japan’s SBIR program was significantly reformed in 2021.

SBIR awards have played a fairly significant role supporting Japan’s space program over the past several years. Astroscale has been awarded a US$ 80m SBIR from MEXT through 2028 for a debris inspection [Satellite Today] mission (this is separate from the ADRAS-J effort funded by JAXA). Ispace has an SBIR to support the Mission 6 lunar lander [ispace], scheduled for 2027. Tenchijin received an SBIR to develop a land surface temperature [SpaceNews] feature for its COMPASS product. Space One, Innovative Space Carrier, and Space Walker have been participating in a multi-year bake-off style competition to build satellite launch vehicles [Nikkei Asia] and funded through the SBIR program and MEXT funds. METI SBIR funds are also supporting remote sensing satellite development.

University research funding: Japan demonstrates a great deal of collaboration between universities and the private sector and government funding for university research and space-related projects is not insignificant. In addition, several space startups have been spun out of university research programs.

International competitors

It would be tough to summarize all of the international competitors to Japan’s efforts to advance its space program, so I would like to focus on a couple of near peers, with a similar scope of ambitions: South Korea and India.

South Korea established KARI, its first aeronautics and space agency in 1989. Korea launched its first rocket in 1993 and its first satellite, Arirang 1, in 1999. In addition to sending an astronaut to the ISS, it has successfully built a three-stage rocket, the Korean Space Launch Vehicle (KSLV-II) (also known as Nuri) providing access to geostationary orbit. In 2024, KARI was absorbed into a new agency, KASA, along with the Korea Astronomy and Space Science Institute (KASI) and a variety of other scattered space program initiatives. Like JAXA, KASA is explicitly tasked with growing the aerospace economy in Korea, catalyzing the establishment of new firms and jobs. Though expected to double to US$ 1.1 billion by 2027, KASA’s budget remains much smaller than JAXA’s, but it has big ambitions, including seven key objectives:

- Make South Korea a top-five space power by 2045

- Increase Korea’s global space flight market share to 10%

- Create more than 2,000 space-related companies and 500,000 jobs in the space industry

- Land on the Moon by 2032

- Establish a lunar base by the 2040s

- Send an orbiter to Mars by 2035

- Land on Mars by 2045

Korea also plans a trip to the Apophis asteroid in 2029, implementation of a Korean controlled navigation and positioning system by 2035 (similar to Japan’s QZSS), and development of high resolution imaging satellites. While the objectives vary somewhat from Japan, South Korea is targeting similar strategic aims: build and maintain a sovereign, domestic launch capacity that supports both defense and industry; grow the domestic space economy in order to both maintain a domestic supply chain and remain internationally competitive; maintain or expand access to resources and capabilities in Earth orbit, the lunar surface, and Mars; and make significant contributions to global advances in space exploration and science.

India has been in the space game since the 1960s, but over the past couple of years, it has begun rapidly increasing the budget and ambitions of ISRO with overall strategic goals that include capturing 8% of the global space market and growing the domestic space economy to US$ 44 billion by 2033. India already has a regional navigation system (IRNSS) that uses a similar quasi-zenith orbit design to the Japanese QZSS. It has already successfully developed complex multi-stage rockets, launched multiple lunar orbiters and landers, and reached Mars with the Mars Orbiter Mission in 2014. It has recently started a crewed space program, Gaganyaan, aimed at crewed flights by 2026 and development of its own crewed space station, Bharatiya Antariksha Station, by 2035. And in February it announced the Indian National Space Promotion and Authorization Centre (IN-SPACe) [Payload] technology adoption fund. At ₹5 billion (~ US$ 57.7 million), the new fund is less than 1% of the Japanese fund, but India has made a speciality out of achieving major space exploration milestones on very limited budgets. Further, it builds on a ₹10 billion (~US$ 115.5 million) venture capital fund established in 2024. Like Japan and Korea, India seeks to promote early-stage technologies from Indian companies into globally competitive commercial offerings, promote domestic R&D, reduce India’s dependence on imported solutions, position India as a significant player in the global space market, and demonstrate engineering and science leadership on the global stage.

Is 10 years enough time to grow and wean an industry?

Japan’s Space Strategy Fund will run through 2034. That may seem some time away but many space technologies require not only capital but also many years of experimentation and even serial failure before they mature. JAXA and the other Japanese agencies involved in this policy may not be able to continue ponying up this kind of funding beyond the 10-year life of the fund. This raises several questions.

One question will be whether Japan’s space industry ecosystem will be able to expand enough to outgrow the initial dependence on government contracts and subsidies. Can it become a sustainable, industry-led ecosystem that is internationally competitive?

Second, it is unlikely that every Fund recipient will be successful; that is the nature of high risk technology development. JAXA has the authority to suspend funding to any recipient that does not meet objectives and milestones, but will it have the discipline to do so?

Third, JAXA will have to strike a balance between allowing adequate time to experiment, build, and mature new technology while maintaining a sense of urgency and cultivating the agility to shift direction as technology evolves and new competitors emerge. The rapid gyrations and turmoil of the AI industry over the past three years is a reminder that industrial policy can easily be overtaken by events.

Until next time,

Robert

Eating a persimmon,

a bell rings:

the Horyuji.

– Masaoka Shiki (1867-1902) - translated by William Scott Wilson

柿くへば

鐘が鳴るなり

法隆法隆寺

Kaki kueba

Kane ga narunari

Houryuuji